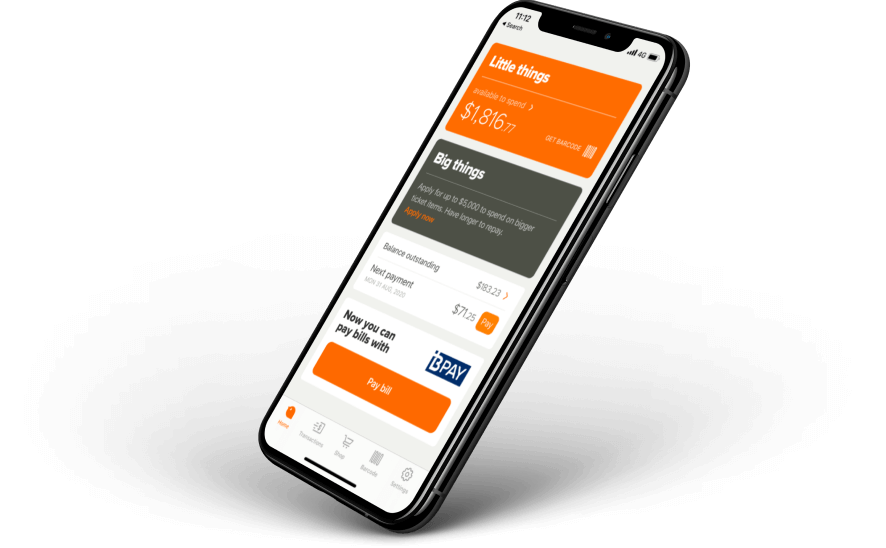

Shop at Sepcon, pay later with humm

IN-STORE //

Shopping at Sepcon just got easier. With humm, you can buy now and pay later in store or online by splitting your payments*.

You can apply for humm online, or ask in-store for more information.

You can also find out more about how humm works here and via our Help Centre.

*Lending criteria, fees and T&Cs apply.

HOW TO SHOP IN-STORE WITH HUMM

To shop with Sepcon in-store, pick your items up around the shop and let the sales assistant know you'd like to pay with humm.

FIND YOUR NEAREST STORE

View related.

FAQs

Making Changes

If you wish to get a quote for a specific retailer please visit the website humm.ie, input your selected partner into the search bar on the top left hand corner, choose ‘get a quote’ and input the amount you wish to spend. If you wish to apply please go to https://apply.humm.ie/s/

After the agreement is settled, unfortunately we are not able to amend the details on it. You will have the option at the time of purchase to view the terms before you complete the purchase both in store with the retailer sales representative or online checkout.

It is important to do this as terms of contract differ from retailer, by amount and interest/fees. Once you accept the terms you will have an option of a 14 days cooling off period to cancel the order with the retail (see cancellation process details in our FAQ’s for further details).

My Account

Yes, you can pay off your humm Agreement early without any additional fees or charges.

The outstanding balance required to fully repay the agreement will be shown for each contract in the

customer portal. Your contract will be automatically closed when the payment has been applied to your

contract and no further payments will be taken.

You can make Additional payments at any time, by logging in to your online customer portal, clicking on

your agreement number starting LAI-00, and click “Make Manual Payment”.

• Additional payments are applied to reduce the outstanding balance.

• Do not replace the scheduled contractual payment which will be processed on the due date

unless the outstanding balance has been fully repaid.

• A request can be made by email to request the monthly payments are recalculated to take

account of any manual payment which has reduced but not cleared the balance. Repayments

will be recalculated over the remaining term of the loan.

You can make an Early payment of a scheduled repayment.

• Payment advice must be provided by email at least 24 hours in advance, Monday to Friday, of the

scheduled repayment date and the amount of the early payment must be at least equal to the

scheduled repayment, including the account keeping fee.

• If advance notice is not provided the scheduled repayment will be attempted on the due date.

• Early payments do not reduce the overall number of scheduled contractual payments.

Your first payment will depend on the terms of the contract you choose.

Where the terms on offer include an application fee this is payable at the time of purchase.

For our 0% APR plans, your first payment will be the initial monthly instalment, which is payable at the time of purchase.

For fortnightly contracts, the first payment is due at the time of purchase and then the next payment will be due 14 days from the date of purchase.

If you’ve opted for a Pay in 3 monthly contract, the first payment is due at the time of purchase and then the next payment due one month after the purchase date.

With other loan products, you have the flexibility to select your first payment date within one month of your purchase date.

It’s recommended to choose a date that aligns with your expected income.

You can find more information about checking your payment dates in your Customer Portal

New Customer

We’re a retail instalment payment plan facility! In simple terms, we’re an easy alternative to paying with cash or credit card for goods offered by our Retail Partners.

humm allows you to spread the cost of your purchase across our partner stores. Each store has different plans to offer, so best check plans with your chosen partner store (retailer). It’s that simple!

Complete a humm application (please ensure that you are not using Internet Explorer) and we will assess it for you. If you are approved for finance with humm, you can use this approval to make purchases in multiple Retail Partner Stores!

Once you’re approved you can proceed to make the purchase (in-store or online) and only need to provide your mobile number at the checkout! You will have the option to view the terms before you complete the purchase contract both in store with the retailer sales representative or online checkout. It is important to do this as terms of contract differ from retailer, by amount and interest/fees. Please note that you will need to provide card details from where we will take the future installments.

You can use one single approval to purchase more than one product, and at more than one store too.

For fees and interest information including our interest free options, select the retailer you wish to use click here to shop. Once you have found the retailer you’d like to shop from, click on the get a quote button to see all available options for that retailer.

To be eligible for humm you must meet the following criteria:

- Be at least 18 years of age

- Provide proof of PPS number & address

- Be an Irish citizen or permanent resident of Ireland

- Earn a minimum taxable income of €1,500 per month- joint spouse/partner income not taken into consideration

- Have a current credit/debit card and a photo ID

- Have a good credit history

Unfortunately there is no way of predicting if you will be approved or not, or what is the maximum amount you can be approved. You will need to complete our application form and go through the assessment in order to get an answer.

You can check all of our partners by clicking here. There you will be able to select the desired category and even filter the results by brand, location and purchase options: in-store and online.

Once you find the desired partner, choose ‘get a quote’ option and input the amount you wish to spend and the details of available payment plans will then be available to you.

If you wish to get a quote for a specific retailer please visit the website humm.ie, input your selected partner into the search bar on the top left hand corner, choose ‘get a quote’ and input the amount you wish to spend. If you wish to apply please go to https://apply.humm.ie/s/

Instore you can choose to pay some of the costs of the purchase using humm and cash/card for the balance.

This isn’t currently available through online checkout. You will need to have sufficient approval level to complete the online purchase with humm.

What documents should I have ready before I apply?

1) ID:

• Passport or

• Irish Driving License

We may be able to accept other documents such as European Driving Licences or Garda Age Card ID cards. They must show your Name and Date of Birth on the front page. We cannot accept Public Service Cards under any circumstances.

2) As proof of earnings / PPS Number verification, we need the following document:

• If you are employed: Payslip from the last month

• If you’re self-employed: Notice of Self Assessment return or Form 11

• If you are receiving benefits: Statement of Benefits

In case the document provided does not contain your PPS Number, we’ll request an alternative document such as Tax Credit Certificate / Form 11, medical card etc.

3) Bank statements within the last 3 months showing a minimum of 35 days transactions.

We may seek an alternative document as proof of address, which must be dated within the past 6 months such as:

• A utility or landline telephone bill

• Department of Social Protection letter or Revenue certificate

• Insurance Policy

• Mortgage Loan Offer

• Lease or Tenancy Agreement

Purchasing with Humm

You can check all of our partners by clicking here. There you will be able to select the desired category and even filter the results by brand, location and purchase options: in-store and online.

Once you find the desired partner, choose ‘get a quote’ option and input the amount you wish to spend and the details of available payment plans will then be available to you.

Warning

If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, which may limit your ability to access credit, a hire-purchase agreement, a consumer-hire agreement or a BNPL agreement in the future.